Obtain Your Reimbursement Faster with a Secure Australian Online Tax Return Filing Choice

Obtain Your Reimbursement Faster with a Secure Australian Online Tax Return Filing Choice

Blog Article

Why You Ought To Consider an Online Tax Return Refine for Your Economic Requirements

In today's busy setting, the on-line income tax return process presents an engaging solution for handling your monetary responsibilities efficiently. By leveraging electronic systems, people can appreciate the comfort of filing from home, which not only conserves time however also reduces the stress connected with conventional methods. These platforms provide boosted accuracy and security attributes, along with the capacity for price financial savings. The true benefit may exist in the access to specialized sources and support that can dramatically impact your tax end result. The concern continues to be: exactly how can these benefits transform your economic technique?

Ease of Online Declaring

The convenience of on the internet declaring has reinvented the way taxpayers approach their tax obligation returns. In an era where time is useful, on-line tax filing systems supply taxpayers with the flexibility to finish their returns from the convenience of their office or homes. This availability removes the need for physical journeys to tax obligation preparers or the blog post office, considerably minimizing the hassle typically connected with traditional filing techniques.

In addition, on-line declaring services offer straightforward interfaces and step-by-step assistance, enabling people to browse the procedure with convenience. Many platforms integrate functions such as automated computations, error-checking, and immediate accessibility to previous year returns, improving the overall filing experience. This technological development not only simplifies the preparation process however likewise equips taxpayers to take control of their monetary obligations.

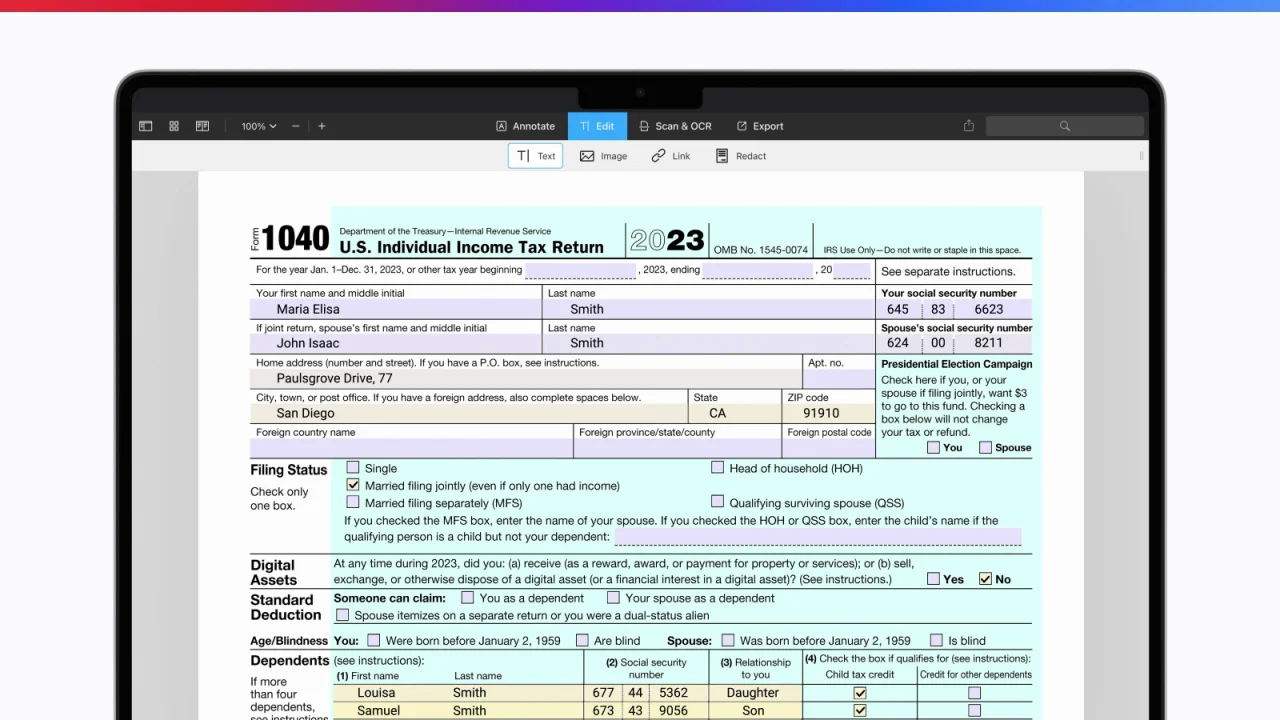

Furthermore, on the internet filing enables the smooth combination of different tax files, including W-2s and 1099s, which can frequently be imported directly into the system. This streamlining of info lessens information entrance errors and improves precision, making certain an extra reliable submission (Australian Online Tax Return). Inevitably, the ease of on-line filing represents a significant change in tax preparation, aligning with the advancing requirements of contemporary taxpayers

Time Efficiency and Rate

Timely conclusion of income tax return is an important element for many taxpayers, and on-line declaring dramatically improves this aspect of the procedure. The electronic landscape enhances the whole income tax return procedure, minimizing the time called for to gather, input, and send essential info. Online tax software program typically includes functions such as pre-filled forms, automated calculations, and easy-to-navigate user interfaces, enabling users to finish their returns much more successfully.

Additionally, the capacity to access tax papers and information from anywhere with an internet link eliminates the requirement for physical documents and in-person appointments. This adaptability enables taxpayers to function on their returns at their convenience, consequently minimizing the anxiety and time stress typically associated with conventional declaring techniques.

Cost-Effectiveness of Digital Solutions

While several taxpayers may initially regard on the internet tax filing remedies as an added expenditure, a closer assessment exposes their fundamental cost-effectiveness. Electronic systems commonly come with lower fees contrasted to traditional tax obligation preparation services. Many on the internet service providers supply tiered prices frameworks that allow taxpayers to pay just for the services they really require, reducing unnecessary prices.

Additionally, the automation intrinsic in online services simplifies the filing process, lowering the chance of human error and the possibility for costly modifications or fines. This efficiency equates to substantial time financial savings, which can equate to monetary cost savings when considering the hourly rates of specialist tax obligation preparers.

Boosted Accuracy and Security

In enhancement to boosted precision, on-line tax obligation filing additionally prioritizes the security of sensitive personal and financial details. Trustworthy online tax services utilize robust encryption innovations to protect data transmission and storage, considerably reducing the risk of identity theft and fraudulence. Normal protection updates and conformity with market requirements better bolster these defenses, giving satisfaction for individuals.

Furthermore, the ability to access tax obligation papers and info safely from anywhere permits greater control over individual economic data. Users can conveniently track their declaring standing and retrieve vital papers without the danger related to physical duplicates. Generally, the combination of heightened precision and safety and security makes online tax obligation filing a sensible option for individuals you can look here looking for to enhance their tax prep work procedure.

Access to Specialist Support

Accessing expert assistance is a considerable benefit of on the internet tax filing systems, providing customers with assistance from educated experts throughout the tax prep work process. A lot of these systems use access to licensed tax professionals that can help with complex tax concerns, guaranteeing that customers make notified choices while taking full advantage of deductions and credit scores.

This professional assistance is commonly readily available through numerous channels, consisting of real-time conversation, video clip calls, and phone appointments. Such accessibility enables taxpayers to look for clarification on particular tax obligation legislations and guidelines or obtain tailored suggestions customized to their unique economic circumstances (Australian Online Tax Return). Having a professional on hand can relieve the tension linked with tax obligation filing, specifically for individuals encountering challenging monetary scenarios or those unfamiliar with the most current tax obligation codes.

In addition, on-line tax platforms regularly provide a wealth of resources, such as educational video clips, write-ups, and FAQs, boosting users' understanding of their tax obligations. This detailed support system not only cultivates confidence throughout the declaring process but additionally outfits customers with useful knowledge for future tax years. Ultimately, leveraging skilled support through on-line tax return procedures can cause even more exact filings and optimized monetary outcomes.

Final Thought

In final thought, the online tax obligation return process offers considerable advantages for individuals seeking to handle their monetary needs efficiently. The comfort of declaring from home, article source incorporated with time effectiveness, cost-effectiveness, boosted accuracy, and durable safety, emphasizes its charm. In addition, accessibility to experienced assistance and sources empowers individuals to enhance reductions and enhance their tax experience. Welcoming digital remedies for tax preparation eventually stands for a forward-thinking technique to financial administration in an increasingly electronic world.

Prompt conclusion of tax obligation returns is an important factor for numerous taxpayers, and online filing substantially enhances this facet of the process. By directing customers via the declaring procedure with instinctive motivates and error alerts, on-line services help to get rid of typical mistakes, leading to a more precise tax return.

In general, the combination of enhanced accuracy and security makes online tax obligation submitting a sensible choice for people looking for to streamline their tax obligation prep work procedure.

Having a professional on hand can alleviate the stress and anxiety linked with tax declaring, specifically for people encountering difficult economic circumstances or those unfamiliar with the latest tax codes.

In addition, on-line tax obligation platforms often give a wide range of resources, such as training video clips, short articles, and Frequently asked questions, improving individuals' understanding of their tax obligation commitments.

Report this page